Blackstone development).Ĭonducting periodic RFPs is a good practice for entities to evaluate and align service providers that best fit the overall goals of their organization and community. Currently, the City does not contract for property tax auditing services and is recommended to be audited following annexation of land within City boundaries (i.e.

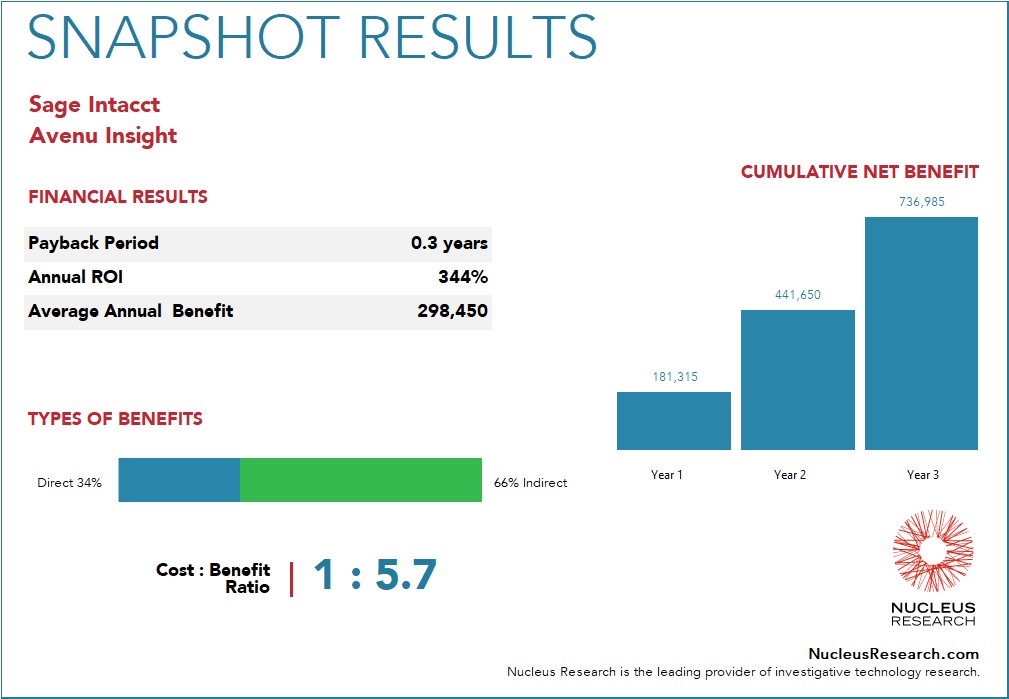

#AVENU INSIGHTS SOFTWARE#

In addition, firms like HdL Companies and Avenu Insight and Analytics offer software access to property tax as well as provide forecasting data and supplemental statistical data needed for the City’s Comprehensive Annual Financial Report (CAFR). Administrative errors and omissions combined with general compliance problems are inevitable given the non-standard, complex nature of state and local property taxes. Property tax auditing services are designed to assist municipal agencies, like the City of Brea, to identify mis-allocated property tax revenue. The Annual “Roll” is the official listing of the taxable value, location and ownership of all locally assessed property. The County Assessor is the elected official mandated by law to value all taxable property located in the county and produces an Annual Assessment Rolls of Value. The City also receives property taxes representing the second largest revenue source for the City's General Fund and is currently projected at $11.5 million for FY 2019-20. In the past three fiscal years from 2014-15 through 2017-18, the firm has produced $578,839 in additional annual sales tax revenue for the City. The City currently contracts with Avenu Insight & Analytics (also known as MuniServices) for services related to SUTA, trend analysis, and sales tax revenue forecasting since 1995. These firms also provide quarterly sales tax analysis reports which include trend analysis, and revenue forecasts specific to the agency. Such firms continuously audit to identify, correct, and recover all sales and use allocation errors, and in return, retain a percentage of the discovered revenue as their commission ("contingency fee"). Municipal agencies, including the City of Brea, contract with specialized firms that maintain large and complete sales tax databases and work directly with the CDTFA, to maximize the agency’s share of the sales and use tax generated by its business community.

The local share (known as Bradley-Burns) is one percent and is remitted to CDTFA by retailers and is later distributed to the jurisdiction where the sale is negotiated, or the order is taken. Sales tax is levied on retailers who sell or rent tangible personal property and is administered through the California Department of Tax and Fee Administration (CDTFA).

Sales tax within the City of Brea is the largest revenue source for the City’s General Fund which is currently projected at $20.4 million for FY 2019-20 and represents approximately 37 percent of the City’s General Fund budget. Authorize the City Manager to execute and administer said agreement.Approve an agreement with Avenu Insight & Analytics, for Sales and Use Tax (SUTA) and property tax audit, analysis, reports and information services and.PRA Group was formed in 1996 and is based in Norfolk, Virginia.Agreement with Avenu Insights & Analytics for Sales and Use Tax (SUTA) and Property Tax Audit, Analysis, Reports and Information Services The Company also provides fee-based services, including contingent collections of defaulted finance receivables in Europe, vehicle location, skip tracing and collateral recovery services for auto lenders, governments and law enforcement via PRA Location Services, LLC, revenue administration, audit and debt discovery/recovery services for local government entities through PRA Government Services, LLC and MuniServices, LLC and class action claims recovery services and related payment processing via Claims Compensation Bureau, LLC. The accounts PRA acquires are the unpaid obligations of individuals owed to credit grantors, which primarily include banks, and other types of consumer, retail, and auto finance companies. PRA's primary business focuses upon the acquisition, collection, and processing of both unpaid and normal-course accounts receivable originally owed to credit grantors, governments, retailers and others. PRA Group is a financial services company.

0 kommentar(er)

0 kommentar(er)